Page 13 - VP-MARCH 2016 final8

P. 13

Time to

SAVE

TAXESand

CREATE

WEALTH

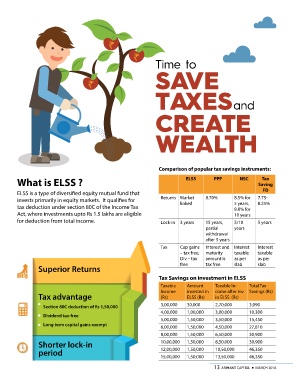

Comparison of popular tax savings instruments:

What is ELSS ? ELSS PPF NSC Tax

Saving

ELSS is a type of diversified equity mutual fund that Returns Market 8.70% 8.5% for

invests primarily in equity markets. It qualifies for linked 5 years, FD

tax deduction under section 80C of the Income Tax 15 years, 8.8% for 7.75-

Act, where investments upto Rs 1.5 lakhs are eligible Lock-in 3 years partial 10 years 8.25%

for deduction from total income. Tax Cap gains withdrawal 5/10 5 years

after 5 years years

Superior Returns – tax free, Interest and Interest

Div – tax maturity Interest taxable

Tax advantage free amount is taxable as per

tax free as per slab

Section 80C deduction of Rs 1,50,000 slab

Dividend tax-free

Long term capital gains exempt Tax Savings on investment in ELSS

Shorter lock-in Taxable Amount Taxable In- Total Tax

period Income invested in come after inv Savings (Rs)

(Rs) ELSS (Rs) in ELSS (Rs)

3,00,000 30,000 2,70,000 3,090

4,00,000 1,00,000 3,00,000 10,300

5,00,000 1,50,000 3,50,000 15,450

6,00,000 1,50,000 4,50,000 27,810

8,00,000 1,50,000 6,50,000 30,900

10,00,000 1,50,000 8,50,000 30,900

12,00,000 1,50,000 10,50,000 46,350

15,00,000 1,50,000 13,50,000 46,350

13 ARIHANT CAPITAL ¡ MARCH 2016