Page 7 - VP-APRIL 2016

P. 7

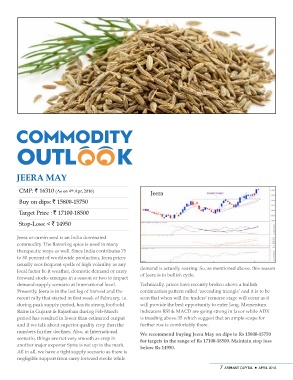

Jeera May Jeera

CMP: ` 16310 (As on 4th Apr, 2016) demand is actually soaring. So, as mentioned above, this season

of Jeera is in bullish cycle.

Buy on dips: ` 15800-15750 Technically, prices have recently broken above a bullish

continuation pattern called ‘ascending triangle’ and it is to be

Target Price : ` 17100-18500 seen that when will the traders’ remorse stage will occur as it

will provide the best opportunity to enter long. Momentum

Stop-Loss: < ` 14950 indicators RSI & MACD are going strong in favor while ADX

is treading above 35 which suggest that an ample scope for

Jeera or cumin seed is an India dominated further rise is comfortably there.

commodity. The flavoring spice is used in many We recommend buying Jeera May on dips to Rs 15800-15750

therapeutic ways as well. Since India contributes 75 for targets in the range of Rs 17100-18500. Maintain stop loss

to 80 percent of worldwide production, Jeera prices below Rs 14950.

usually sees frequent spells of high volatility as any

local factor be it weather, domestic demand or carry 7 ARIHANT CAPITAL ¡ APRIL 2016

forward stocks emerges in a season or two to impact

demand-supply scenario at International level.

Presently, Jeera is in the last leg of harvest and the

recent rally that started in first week of February, i.e.

during peak supply period, has its strong foothold.

Rains in Gujarat & Rajasthan during Feb-March

period has resulted in lower than estimated output

and if we talk about superior quality crop then the

numbers further declines. Also, at International

scenario, things are not very smooth as crop in

another major exporter Syria is not up to the mark.

All in all, we have a tight supply scenario as there is

negligible support from carry forward stocks while