Page 4 - 1701349_VP_DEC_FINAL

P. 4

FUNDAMENTAL

ST CK

Federal Bank Ltd. developments and affordable homes. As a part

of diversification strategy, company aims to

Accumulate Target Price Rs 350 increase revenues from the leasing business.

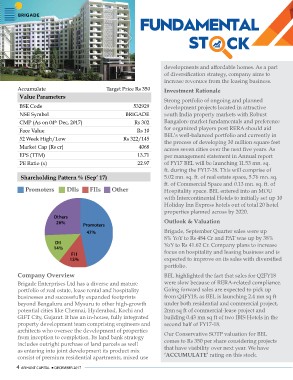

Value Parameters

532929 Investment Rationale

BSE Code BRIGADE

NSE Symbol Strong portfolio of ongoing and planned

CMP (As on 04th Dec, 2017) Rs 302 development projects located in attractive

Face Value Rs 10 south India property markets with Robust

52 Week High/Low Rs 322/145 Bangalore market fundamentals and preference

Market Cap (Rs cr) 4068 for organized players post RERA should aid

EPS (TTM) 13.71 BEL’s well-balanced portfolio and currently in

PE Ratio (x) 22.97 the process of developing 30 million square feet

across seven cities over the next five years. As

Shareholding Pattern % (Sep’ 17) per management statement in Annual report

Promoters Dlls FIIs Other of FY17 BEL will be launching 11.53 mn. sq.

ft. during the FY17-18. This will comprise of

Others Promoters 5.02 mn. sq. ft. of real estate space, 5.76 mn. sq.

26% 47% ft. of Commercial Space and 0.13 mn. sq. ft. of

Hospitality space. BEL entered into an MOU

DII with Intercontinental Hotels to initially set up 10

14% Holiday Inn Express hotels out of total 20 hotel

properties planned across by 2020.

FI I

13% Outlook & Valuation

Company Overview Brigade, September Quarter sales were up

8% YoY to Rs 484 Cr and PAT was up by 38%

Brigade Enterprises Ltd has a diverse and mature YoY to Rs 41.62 Cr. Company plans to increase

portfolio of real estate, lease rental and hospitality focus on hospitality and leasing business and is

businesses and successfully expanded footprints expected to improve on its sales with diversified

beyond Bengaluru and Mysuru to other high-growth portfolio.

potential cities like Chennai, Hyderabad, Kochi and

GIFT City, Gujarat. It has an in-house, fully integrated BEL highlighted the fact that sales for Q2FY18

property development team comprising engineers and were slow because of RERA-related compliance.

architects who oversee the development of properties Going forward sales are expected to pick up

from inception to completion. Its land bank strategy from Q4FY18, as BEL is launching 2.4 mn sq ft

includes outright purchase of land parcels as well under both residential and commercial project,

as entering into joint development its product mix 2mn sq ft of commercial-lease project and

consist of premium residential apartments, mixed use building 0.43 mn sq ft of two IBIS Hotels in the

second half of FY17-18.

4 ARIHANT CAPITAL ¡ dECembER 2017

Our Conservative SOTP valuation for BEL

comes to Rs 350 per share considering projects

that have visibility over next year. We have

‘ACCUMULATE’ rating on this stock.