Page 4 - 1701188_Value_Plus_oct_2017

P. 4

FUNDAMENTAL

ST CK

Federal Bank Ltd. others segment includes logistics, after-

market and investment.

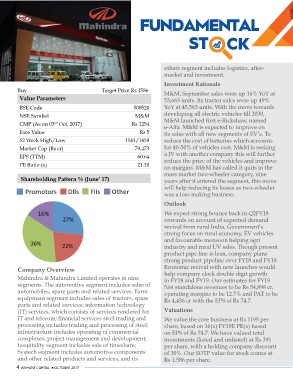

Buy Target Price Rs 1586 Investment Rationale

Value Parameters M&M, September sales were up 16% YoY at

500520 53,663 units. Its tractor sales were up 49%

BSE Code M&M YoY at 45,563 units. With the move towards

NSE Symbol Rs 1254 developing all electric vehicles till 2030,

CMP (As on 03rd Oct, 2017) M&M launched first e-Rickshaw, named

Face Value Rs 5 e-Alfa. M&M is expected to improve on

52 Week High/Low 1141/1459 its sales with all new segments of EV’s. To

Market Cap (Rs cr) reduce the cost of batteries which accounts

EPS (TTM) 79,473 for 40-50% of vehicles cost. M&M is seeking

PE Ratio (x) 60.64 a JV with another company this will further

21.10 reduce the price of the vehicles and improve

on margins. M&M has called it quits in the

Shareholding Pattern % (June’ 17) mass market two-wheeler category, nine

years after it entered the segment, this move

Promotors Dlls FIIs Other will help reducing its losses as two-wheeler

was a loss making business.

Company Overview Outlook

Mahindra & Mahindra Limited operates in nine We expect strong bounce back in Q2FY18

segments. The automotive segment includes sales of onwards on account of expected demand

automobiles, spare parts and related services. Farm revival from rural India, Government’s

equipment segment includes sales of tractors, spare strong focus on rural economy, EV vehicles

parts and related services; information technology and favourable monsoon helping agri

(IT) services, which consists of services rendered for industry and rural UV sales. Though present

IT and telecom; financial services steel trading and product pipe line is lean, company plans

processing includes trading and processing of steel; strong product pipeline over FY18 and FY19.

infrastructure includes operating of commercial Economic revival with new launches would

complexes, project management and development; help company clock double digit growth

hospitality segment includes sale of timeshare; in FY18 and FY19. Our estimates for FY19

Systech segment includes automotive components Net standalone revenues to be Rs 54,898 cr,

and other related products and services, and its operating margins to be 12.7% and PAT to be

Rs 4,436 cr with the EPS of Rs 74.7.

4 ARIHANT CAPITAL ¡ OCTOBER 2017 Valuations

We value the core business at Rs 1195 per

share, based on 16(x) FY19E PE(x) based

on EPS of Rs 74.7. We have valued total

investments (listed and unlisted) at Rs 391

per share, with a holding company discount

of 30%. Our SOTP value for stock comes at

Rs 1,586 per share.