Page 7 - 2274_Value_Plus_Nov_2016

P. 7

Jeera

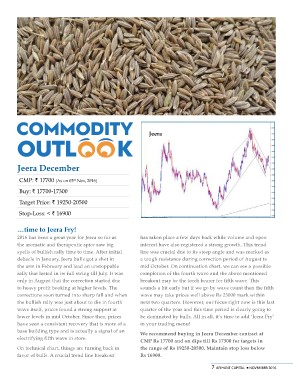

Jeera December has taken place a few days back while volume and open

interest have also registered a strong growth. This trend

CMP: ` 17700 (As on 03rd Nov, 2016) line was crucial due to its steep angle and was marked as

a tough resistance during correction period of August to

Buy: ` 17700-17300 mid October. On continuation chart, we can see a possible

completion of the fourth wave and the above mentioned

Target Price: ` 19250-20500 breakout may be the torch bearer for fifth wave. This

sounds a bit early but if we go by wave count then the fifth

Stop-Loss: < ` 16900 wave may take prices well above Rs 23000 mark within

next two quarters. However, our focus right now is this last

…time to Jeera Fry! quarter of the year and this time period is clearly going to

be dominated by bulls. All in all, it’s time to add ‘Jeera Fry’

2016 has been a great year for Jeera so far as in your trading menu!

the aromatic and therapeutic spice saw big

spells of bullish rally time to time. After initial We recommend buying in Jeera December contract at

debacle in January, Jeera bulls got a shot in CMP Rs 17700 and on dips till Rs 17300 for targets in

the arm in February and lead an unstoppable the range of Rs 19250-20500. Maintain stop loss below

rally that lasted in its full swing till July. It was Rs 16900.

only in August that the correction started due

to heavy profit booking at higher levels. The 7 ARIHANT CAPITAL ¡ NOVEMBER 2016

corrections soon turned into sharp fall and when

the bullish rally was just about to die in fourth

wave itself, prices found a strong support at

lower levels in mid October. Since then, prices

have seen a consistent recovery that is more of a

base building type and is actually a signal of an

electrifying fifth wave in store.

On technical chart, things are turning back in

favor of bulls. A crucial trend line breakout