Page 5 - Value Plus

P. 5

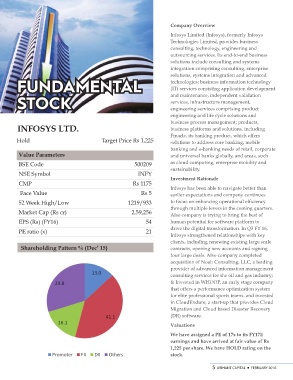

fundamental Company Overview

stock

Infosys Limited (Infosys), formerly Infosys

INFOSYS LTD. Target Price Rs 1,225 Technologies Limited, provides business

consulting, technology, engineering and

Hold 500209 outsourcing services. Its end-to-end business

INFY solutions include consulting and systems

Value Parameters integration comprising consulting, enterprise

BSE Code Rs 1175 solutions, systems integration and advanced

NSE Symbol Rs 5 technologies; business information technology

CMP (IT) services consisting application development

Face Value 1219/933 and maintenance, independent validation

52 Week High/Low 2,59,256 services, infrastructure management,

Market Cap (Rs cr) 54 engineering services comprising product

EPS (Rs) (FY16) 21 engineering and life cycle solutions and

PE ratio (x) business process management; products,

business platforms and solutions, including

Shareholding Pattern % (Dec’ 15) Finacle, its banking product, which offers

solutions to address core banking, mobile

banking and e-banking needs of retail, corporate

and universal banks globally, and areas, such

as cloud computing, enterprise mobility and

sustainability.

Investment Rationale

Infosys has been able to navigate better than

earlier expectations and company continues

to focus on enhancing operational efficiency

through multiple levers in the coming quarters.

Also company is trying to bring the best of

human potential for software platform to

drive the digital transformation. In Q3 FY 16,

Infosys strengthened relationships with key

clients, including renewing existing large scale

contracts, opening new accounts and signing

four large deals. Also company completed

acquisition of Noah Consulting, LLC, a leading

provider of advanced information management

consulting services for the oil and gas industry;

& Invested in WHOOP, an early stage company

that offers a performance optimization system

for elite professional sports teams, and invested

in CloudEndure, a start-up that provides Cloud

Migration and Cloud based Disaster Recovery

(DR) software.

Valuations

We have assigned a PE of 17x to its FY17E

earnings and have arrived at fair value of Rs

1,225 per share. We have HOLD rating on the

stock.

5 ARIHANT CAPITAL ¡ FEBRUARY 2016