Page 7 - Value Plus

P. 7

crude oil

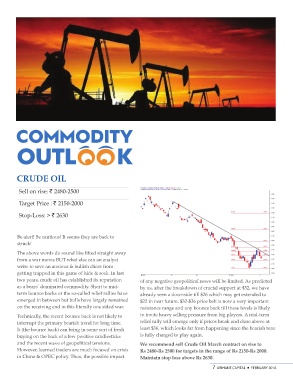

Sell on rise: ` 2480-2500

Target Price : ` 2150-2000

Stop-Loss: > ` 2630

Be alert! Be cautious! It seems they are back to of any negative geopolitical news will be limited. As predicted

struck! by us, after the breakdown of crucial support at $32, we have

already seen a downside till $26 which may get extended to

The above words do sound like lifted straight away $22 in near future. $32-$36 price belt is now a very important

from a war movie BUT what else can an analyst resistance range and any bounce back till these levels is likely

write to save an anxious & bullish client from to invite heavy selling pressure from big players. A mid-term

getting trapped in this game of hide & seek. In last relief rally will emerge only if prices break and close above at

two years, crude oil has established its reputation least $36, which looks far from happening since the bearish tone

as a bears’ dominated commodity. Short to mid- is fully charged to play again.

term bounce backs or the so-called relief rallies have

emerged in between but bulls have largely remained We recommend sell Crude Oil March contract on rise to

on the receiving end in this literally one sided war. Rs 2480-Rs 2500 for targets in the range of Rs 2150-Rs 2000.

Maintain stop loss above Rs 2630.

Technically, the recent bounce back is not likely to

interrupt the primary bearish trend for long time. 7 ARIHANT CAPITAL ¡ FEBRUARY 2016

It (the bounce back) can bring in some sort of fresh

buying on the back of a few positive candlesticks

and the recent wave of geopolitical tensions.

However, learned traders are much focused on crisis

in China & OPEC policy. Thus, the possible impact