Page 4 - VP-MARCH 2016 final8

P. 4

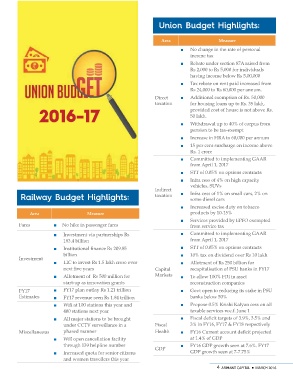

Union Budget Highlights:

2016-17 Area Measure

Railway Budget Highlights: Direct ¢ No change in the rate of personal

taxation income tax

Area Measure

Indirect ¢ Rebate under section 87A raised from

Fares ¢ No hike in passenger fares taxation Rs 2,000 to Rs 5,000 for individuals

having income below Rs 5,00,000

¢ Investment via partnerships Rs Capital

183.4 billion Markets ¢ Tax rebate on rent paid increased from

Investment ¢ Fiscal Rs 24,000 to Rs 60,000 per annum.

¢ Institutional finance Rs 209.85 Health

billion GDP ¢ Additional exemption of Rs. 50,000

¢ for housing loans up to Rs. 35 lakh,

LIC to invest Rs 1.5 lakh crore over provided cost of house is not above Rs.

FY17 ¢ next five years 50 lakh.

Estimates ¢

¢ Allotment of Rs 500 million for ¢ Withdrawal up to 40% of corpus from

start-up as innovation grants pension to be tax-exempt

¢

FY17 plan outlay Rs 1.21 trillion ¢ Increase in HRA to 60,000 per annum

Miscellaneous

¢ FY17 revenue seen Rs 1.84 trillion ¢ 15 per cent surcharge on income above

Rs. 1 crore

¢ Wifi at 100 stations this year and

400 stations next year ¢ Committed to implementing GAAR

from April 1, 2017

All major stations to be brought

under CCTV surveillance in a ¢ STT of 0.05% on options contracts

phased manner

¢ Infra cess of 4% on high capacity

Will open cancellation facility vehicles, SUVs

through 139 helpline number

¢ Infra cess of 1% on small cars, 2% on

Increased quota for senior citizens some diesel cars

and women travellers this year

¢ Increased excise duty on tobacco

products by 10-15%

¢ Services provided by EPFO exempted

from service tax

¢ Committed to implementing GAAR

from April 1, 2017

¢ STT of 0.05% on options contracts

¢ 10% tax on dividend over Rs 10 lakh

¢ Allotment of Rs 250 billion for

recapitalisation of PSU banks in FY17

¢ To allow 100% FDI in asset

reconstruction companies

¢ Govt open to reducing its stake in PSU

banks below 50%

¢ Propose 0.5% Krishi Kalyan cess on all

taxable services w.e.f. June 1

¢ Fiscal deficit targets of 3.9%, 3.5% and

3% in FY16, FY17 & FY18 respectively

¢ FY16 Current account deficit projected

at 1.4% of GDP

¢ FY16 GDP growth seen at 7.6%. FY17

GDP growth seen at 7-7.75%

4 ARIHANT CAPITAL ¡ MARCH 2016