Page 7 - VP-MARCH 2016 final8

P. 7

fundamental Company Overview

pick

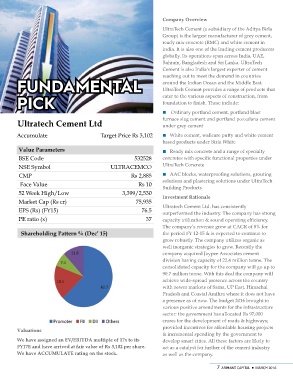

UltraTech Cement (a subsidiary of the Aditya Birla

Ultratech Cement Ltd Group) is the largest manufacturer of grey cement,

ready mix concrete (RMC) and white cement in

Accumulate Target Price Rs 3,102 India. It is also one of the leading cement producers

globally. Its operations span across India, UAE,

Value Parameters 532528 Bahrain, Bangladesh and Sri Lanka. UltraTech

BSE Code ULTRACEMCO Cement is also India's largest exporter of cement

NSE Symbol reaching out to meet the demand in countries

CMP Rs 2,885 around the Indian Ocean and the Middle East.

Face Value Rs 10 UltraTech Cement provides a range of products that

52 Week High/Low cater to the various aspects of construction, from

Market Cap (Rs cr) 3,399/2,530 foundation to finish. These include:

EPS (Rs) (FY15) 75,935

PE ratio (x) 76.5 ¢ Ordinary portland cement, portland blast

37 furnace slag cement and portland pozzalana cement

under grey cement

Shareholding Pattern % (Dec’ 15)

¢ White cement, wallcare putty and white cement

Valuations based products under Birla White

We have assigned an EV/EBITDA multiple of 17x to its ¢ Ready mix concrete and a range of specialty

FY17E and have arrived at fair value of Rs 3,102 per share. concretes with specific functional properties under

We have ACCUMULATE rating on the stock. UltraTech Concrete

¢ AAC blocks, waterproofing solutions, grouting

solutions and plastering solutions under UltraTech

Building Products

Investment Rationale

Ultratech Cement Ltd. has consistently

outperformed the industry. The company has strong

capacity utilization & sound operating efficiency.

The company’s revenue grew at CAGR of 8% for

the period FY 12-15 & is expected to continue to

grow robustly. The company utilizes organic as

well inorganic strategies to grow. Recently the

company acquired Jaypee Associates cement

division having capacity of 22.4 million tonne. The

consolidated capacity for the company will go up to

90.7 million tonne. With this deal the company will

achieve wide-spread presence across the country

with newer markets of Satna, UP East, Himachal

Pradesh and Coastal Andhra where it does not have

a presence as of now. The budget 2016 brought in

various positive amendments for the infrastructure

sector: the government has allocated Rs 97,000

crores for the development of roads & highways;

provided incentives for affordable housing projects

& incremental spending by the government to

develop smart cities. All these factors are likely to

act as a catalyst for further of the cement industry

as well as the company.

7 ARIHANT CAPITAL ¡ MARCH 2016