Page 5 - 1411_Value Plus May 2016

P. 5

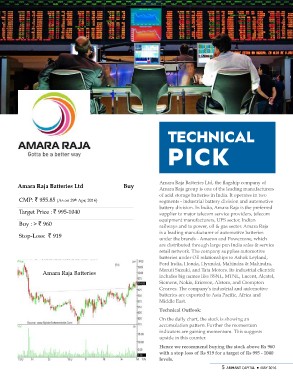

Amara Raja Batteries Ltd Buy technical

CMP: ` 955.85 (As on 29th Apr, 2016)

Target Price : ` 995-1040 pick

Buy : > ` 960

Stop-Loss: ` 919 Amara Raja Batteries Ltd, the flagship company of

Amara Raja group is one of the leading manufacturers

Amara Raja Batteries of acid storage batteries in India. It operates in two

segments - industrial battery division and automotive

battery division. In India, Amara Raja is the preferred

supplier to major telecom service providers, telecom

equipment manufacturers, UPS sector, Indian

railways and to power, oil & gas sector. Amara Raja

is a leading manufacturer of automotive batteries

under the brands - Amaron and Powerzone, which

are distributed through large pan India sales & service

retail network. The company supplies automotive

batteries under OE relationships to Ashok Leyland,

Ford India, Honda, Hyundai, Mahindra & Mahindra,

Maruti Suzuki, and Tata Motors. Its industrial clientele

includes big names like BSNL, MTNL, Lucent, Alcatel,

Siemens, Nokia, Ericsson, Alstom, and Crompton

Greaves. The company’s industrial and automotive

batteries are exported to Asia Pacific, Africa and

Middle East.

Technical Outlook:

On the daily chart, the stock is showing an

accumulation pattern. Further the momentum

indicators are gaining momentum. This suggests

upside in this counter.

Hence we recommend buying the stock above Rs 960

with a stop loss of Rs 919 for a target of Rs 995 - 1040

levels.

5 ARIHANT CAPITAL ¡ MAY 2016