Page 7 - 1411_Value Plus May 2016

P. 7

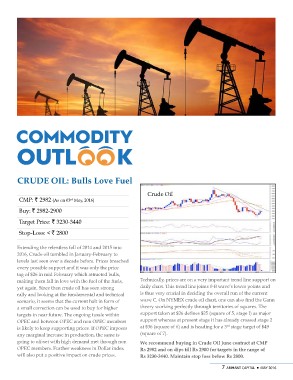

CRUDE OIL: Bulls Love Fuel Crude Oil

CMP: ` 2982 (As on 03rd May, 2016)

Buy: ` 2982-2900

Target Price: ` 3230-3440

Stop-Loss: < ` 2800

Extending the relentless fall of 2014 and 2015 into Technically, prices are on a very important trend line support on

2016, Crude oil tumbled in January-February to daily chart. This trend line joints 0-B wave’s lower points and

levels last seen over a decade before. Prices breached is thus very crucial in deciding the overall run of the current

every possible support and it was only the price wave C. On NYMEX crude oil chart, one can also find the Gann

tag of $26 in mid February which attracted bulls, theory working perfectly through territories of squares. The

making them fall in love with the fuel of the fuels, support taken at $26 defines $25 (square of 5, stage I) as major

yet again. Since then crude oil has seen strong support whereas at present stage it has already crossed stage 2

rally and looking at the fundamental and technical at $36 (square of 6) and is heading for a 3rd stage target of $49

scenario, it seems that the current halt in form of (square of 7).

a small correction can be used to buy for higher

targets in near future. The ongoing tussle within We recommend buying in Crude Oil June contract at CMP

OPEC and between OPEC and non OPEC members Rs 2982 and on dips till Rs 2900 for targets in the range of

is likely to keep supporting prices. If OPEC imposes Rs 3230-3440. Maintain stop loss below Rs 2800.

any marginal increase in production, the same is

going to off-set with high demand met through non 7 ARIHANT CAPITAL ¡ MAY 2016

OPEC members. Further weakness in Dollar index

will also put a positive impact on crude prices.