Page 5 - 1700557_Value_Plus_MAY_01_2017

P. 5

FUNDAMENTAL

ST CK

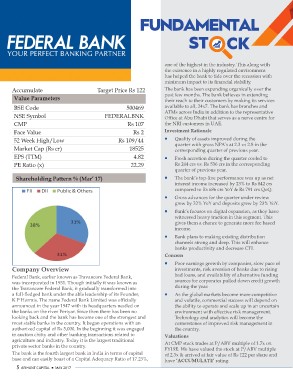

Federal Bank Ltd. one of the highest in the industry. This along with

the existence in a highly regulated environment

Accumulate Target Price Rs 122 has helped the bank to tide over the recession with

Value Parameters minimum impact to its financial stability.

500469 The bank has been expanding organically over the

BSE Code FEDERALBNK past few months. The bank believes in extending

NSE Symbol their reach to their customers by making its services

CMP Rs 107 available to all, 24x7. The bank has branches and

Face Value Rs 2 ATMs across India in addition to the representative

52 Week High/Low Office at Abu Dhabi that serves as a nerve centre for

Market Cap (Rs cr) Rs 109/44 the NRI customers in UAE.

EPS (TTM) 18525 Investment Rationale

PE Ratio (x) 4.82

22.29 ¡ Quality of assets improved during the

quarter with gross NPA’s at 2.3 vs 2.8 in the

Shareholding Pattern % (Mar’ 17) corresponding quarter of previous year.

Company Overview ¡ Fresh accretion during the quarter cooled to

Rs 244 crs vs. Rs 536 crs in the corresponding

Federal Bank, earlier known as Travancore Federal Bank, quarter of previous year.

was incorporated in 1931. Though initially it was known as

the Travancore Federal Bank, it gradually transformed into ¡ The bank’s top-line performance was up as net

a full-fledged bank under the able leadership of its Founder, interest income increased by 23% to Rs 842 crs

K P Hormis. The name Federal Bank Limited was officially compared to Rs 686 crs YoY & Rs 791 crs QoQ.

announced in the year 1947 with its headquarters nestled on

the banks on the river Periyar. Since then there has been no ¡ Gross advances for the quarter under review

looking back and the bank has become one of the strongest and grew by 32% YoY and deposits grew by 23% YoY.

most stable banks in the country. It began operations with an

authorized capital of Rs 5,000. In the beginning it was engaged ¡ Bank’s focuses on digital expansion, as they have

in auction chitty and other banking transactions related to witnessed heavy traction in this segment. This

agriculture and industry. Today it is the largest traditional gives them a chance to generate more fee based

private sector banks in the country. income.

The bank is the fourth largest bank in India in terms of capital

base and can easily boast of a Capital Adequacy Ratio of 17.23%, ¡ Bank plans to making existing distribution

channels strong and deep. This will enhance

5 ARIHANT CAPITAL ¡ MAY 2017 banks productivity and decrease CTI.

Concern

¡ Poor earnings growth by companies, slow pace of

investments, risk aversion of banks due to rising

bad loans, and availability of alternative funding

sources for corporates pulled down credit growth

during the year.

¡ As the global markets become more competitive

and volatile, commercial success will depend on

the ability to operate and scale up in an uncertain

environment with effective risk management.

Technology and analytics will become the

cornerstones of improved risk management in

the country.

Valuations

At CMP stock trades at P/ABV multiple of 1.7x on

FY19E. We have valued the stock at P/ABV multiple

of 2.3x & arrived at fair value of Rs 122 per share and

have ‘ACCUMULATE’ rating.