Page 3 - 2120_Value_Plus_Oct_2016

P. 3

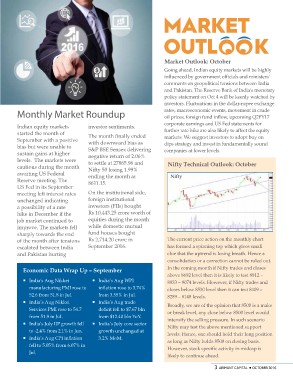

Monthly Market Roundup Market Outlook: October

Indian equity markets investor sentiments. Going ahead, Indian equity markets will be highly

started the month of influenced by government officials and ministers'

September with a positive The month finally ended comments on geopolitical tensions between India

bias but were unable to with downward bias as and Pakistan. The Reserve Bank of India's monetary

sustain gains at higher S&P BSE Sensex delivering policy statement on Oct 4 will be keenly watched by

levels. The markets were negative return of 2.06% investors. Fluctuations in the dollar-rupee exchange

cautious during the month to settle at 27865.96 and rates, macroeconomic events, movement in crude

awaiting US Federal Nifty 50 losing 1.99% oil prices, foreign fund inflow, upcoming Q2FY17

Reserve meeting. The ending the month at corporate earnings and US Fed statements for

US Fed in its September 8611.15. further rate hike are also likely to affect the equity

meeting left interest rates markets. We suggest investors to adopt buy on

unchanged indicating On the institutional side, dips strategy and invest in fundamentally sound

a possibility of a rate foreign institutional companies at lower levels.

hike in December if the investors (FIIs) bought

job market continued to Rs 10,443.25 crore worth of Nifty Technical Outlook: October

improve. The markets fell equities during the month

sharply towards the end while domestic mutual Nifty

of the month after tensions fund houses bought

escalated between India Rs 2,714.20 crore in The current price action on the monthly chart

and Pakistan hurting September 2016. has formed a spinning top which gives small

clue that the uptrend is losing breath. Hence a

Economic Data Wrap Up – September consolidation or a correction cannot be ruled out.

In the coming month if Nifty trades and closes

¡ India's Aug Nikkei ¡ India’s Aug WPI above 8692 level then it is likely to test 8812 –

manufacturing PMI rose to inflation rose to 3.74% 8933 – 9074 levels. However, if Nifty trades and

52.6 from 51.8 in Jul. from 3.55% in Jul. closes below 8530 level then it can test 8409 –

8289 – 8148 levels.

¡ India’s Aug Nikkei ¡ India’s Aug trade Broadly, we are of the opinion that 8500 is a make

Services PMI rose to 54.7 deficit fell to $7.67 bln or break level, any close below 8500 level would

from 51.9 in Jul. from $12.40 bln YoY. intensify the selling pressure. In such scenario

Nifty may test the above mentioned support

¡ India’s July IIP growth fell ¡ India’s July core sector levels. Hence, one should hold their long position

to -2.4% from 2.1% in Jun. growth unchanged at as long as Nifty holds 8500 on closing basis.

3.2% MoM. However, stock specific activity in midcap is

¡ India’s Aug CPI inflation likely to continue ahead.

fell to 5.05% from 6.07% in

Jul. 3 ARIHANT CAPITAL ¡ OCTOBER 2016