Page 5 - 2120_Value_Plus_Oct_2016

P. 5

FUNDAMENTAL

STOCK

Karnataka Bank Ltd. 88 years experience at the forefront of providing

professional banking services and quality customer

BUY Target Price Rs 197 service, the bank now has a national presence with

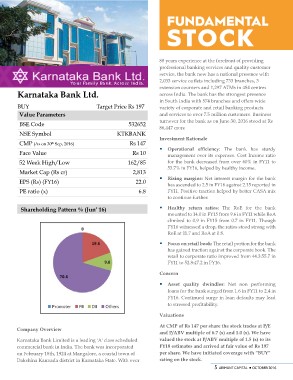

Value Parameters 2,033 service outlets including 733 branches, 3

BSE Code 532652 extension counters and 1,297 ATMs in 484 centres

NSE Symbol KTKBANK across India. The bank has the strongest presence

CMP (As on 30th Sep, 2016) in South India with 574 branches and offers wide

Face Value Rs 147 variety of corporate and retail banking products

52 Week High/Low Rs 10 and services to over 7.5 million customers. Business

Market Cap (Rs cr) 162/85 turnover for the bank as on June 30, 2016 stood at Rs

EPS (Rs) (FY16) 2,813 86,447 crore

PE ratio (x)

22.0 Investment Rationale

6.8

§ Operational efficiency: The bank has sturdy

Shareholding Pattern % (Jun’ 16) management over its expenses. Cost Income ratio

for the bank decreased from over 60% in FY11 to

Company Overview 53.7% in FY16, helped by healthy income.

Karnataka Bank Limited is a leading 'A' class scheduled § Rising margins: Net interest margin for the bank

commercial bank in India. The bank was incorporated has ascended to 2.5 in FY16 against 2.15 reported in

on February 18th, 1924 at Mangalore, a coastal town of FY11. Positive traction helped by better CASA mix

Dakshina Kannada district in Karnataka State. With over to continue further.

§ Healthy return ratios: The RoE for the bank

mounted to 14.0 in FY15 from 9.6 in FY11 while RoA

climbed to 0.9 in FY15 from 0.7 in FY11. Though

FY16 witnessed a drop, the ratios stood strong with

RoE at 11.7 and RoA at 0.8.

§ Focus on retail book: The retail portion for the bank

has gained traction against the corporate book. The

retail to corporate ratio improved from 44.3:55.7 in

FY11 to 52.8:47.2 in FY16.

Concern

§ Asset quality dwindles: Net non performing

loans for the bank surged from 1.6 in FY11 to 2.4 in

FY16. Continued surge in loan defaults may lead

to stressed profitability.

Valuations

At CMP of Rs 147 per share the stock trades at P/E

and P/ABV multiple of 6.7 (x) and 1.0 (x). We have

valued the stock at P/ABV multiple of 1.5 (x) to its

FY18 estimates and arrived at fair value of Rs 197

per share. We have initiated coverage with “BUY”

rating on the stock.

5 ARIHANT CAPITAL ¡ OCTOBER 2016