Page 5 - 2426_Value_Plus_Dec123

P. 5

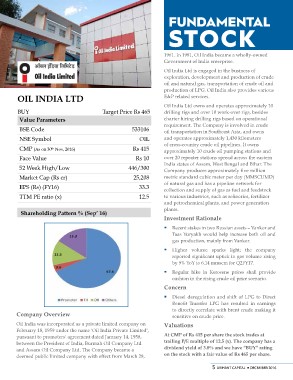

OIL INDIA LTD Target Price Rs 465 FUNDAMENTAL

BUY 533106 STOCK

Value Parameters OIL

BSE Code 1961. In 1981, Oil India became a wholly-owned

NSE Symbol Rs 415 Government of India enterprise.

CMP (As on 30th Nov, 2016) Rs 10

Face Value 446/300 Oil India Ltd is engaged in the business of

52 Week High/Low 25,208 exploration, development and production of crude

Market Cap (Rs cr) oil and natural gas, transportation of crude oil and

EPS (Rs) (FY16) 33.3 production of LPG. Oil India also provides various

TTM PE ratio (x) 12.5 E&P related services.

Shareholding Pattern % (Sep’ 16) Oil India Ltd owns and operates approximately 10

drilling rigs and over 10 work-over rigs, besides

Company Overview charter hiring drilling rigs based on operational

requirement. The Company is involved in crude

Oil India was incorporated as a private limited company on oil transportation in Southeast Asia, and owns

February 18, 1959 under the name 'Oil India Private Limited', and operates approximately 1,430 kilometers

pursuant to promoters' agreement dated January 14, 1958, of cross-country crude oil pipelines. It owns

between the President of India, Burmah Oil Company Ltd approximately 10 crude oil pumping stations and

and Assam Oil Company Ltd. The Company became a over 20 repeater stations spread across the eastern

deemed public limited company with effect from March 28, India states of Assam, West Bengal and Bihar. The

Company produces approximately five million

metric standard cubic meter per day (MMSCUMD)

of natural gas and has a pipeline network for

collection and supply of gas as fuel and feedstock

to various industries, such as refineries, fertilizer

and petrochemical plants, and power generation

plants.

Investment Rationale

§ Recent stakes in two Russian assets – Vankor and

Taas Yuryakh would help increase both oil and

gas production, mainly from Vankor.

§ Higher volume sparks light; the company

reported significant uptick in gas volume rising

by 9% YoY to 6.14 mmscm for Q2FY17.

§ Regular hike in Kerosene prices shall provide

cushion in the rising crude oil price scenario.

Concern

§ Diesel deregulation and shift of LPG to Direct

Benefit Transfer LPG has resulted in earnings

to directly correlate with brent crude making it

sensitive on crude price.

Valuations

At CMP of Rs 415 per share the stock trades at

trailing P/E multiple of 12.5 (x). The company has a

dividend yield of 3.8% and we have “BUY” rating

on the stock with a fair value of Rs 465 per share.

5 ARIHANT CAPITAL ¡ DECEMBER 2016